car sales tax wake county nc

Important information on your PIN. For example imagine you are purchasing a vehicle for 30000 with a highway-use tax of 3.

Skyrocketing Home Prices In Wake County Lead To 250 000 Price Increases In These Neighborhoods Abc11 Raleigh Durham

County and Transit Sales and Use.

. A full list of these can be found below. To review the rules in North Carolina visit our state-by-state guide. For vehicles that are being rented or leased see see taxation of leases and rentals.

For tax rates in other cities see North Carolina sales taxes by city and county. Wake County sales tax. This calculator is designed to estimate the county vehicle property tax for your vehicle.

The 2018 United States Supreme Court decision in South Dakota v. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

Includes the 050 transit county sales and use tax. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. The average cumulative sales tax rate between all of them is 725.

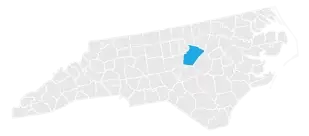

Vehicles are also subject to property taxes which the NC. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. Wake County is located in North Carolina and contains around 14 cities towns and other locations.

Do North Carolina vehicle taxes apply to trade-ins and. The most populous location in Wake County North Carolina is Raleigh. Wake County Tax Administration PO.

You will pay both the registration fee and property taxes to the NCDMV using one of these three payment options. Multiply the vehicle price after any trade-ins but before incentives by the sales tax fee. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

The December 2020 total local. By Mail Send a check or money order to the address listed on your renewal notice. Johnston street smithfield nc 27577 collections mailing address.

The Wake County sales tax rate is. Apex Nc Apex Nature Park Opens December 2013 Near Bella Casa Del Norte Park Apex Nc To attach a lien to real estate the creditor can take or mail the Abstract of Judgment to the county recorders office in any California county where the debtor owns real estate now or may own it in the future. See reviews photos directions phone numbers and more for Nc Sales Tax In Wake County locations in Cary NC.

The calculator should not be used to determine your actual tax bill. Wake County NC. Contact the Wake County Department of Tax Administration.

Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Bad Credit Loans. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval. There is no applicable city tax.

Online Visit DMVs online registration system to pay with your credit or check card. Vehicle Taxes Taxes North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Dry Cleaners for Sale in Wake County NC.

Box 2719 Raleigh NC 27602-2719 For assistance in completing an application or questions regarding the Vehicle Rental Tax please call the Wake County Department of Tax Administration at 919-856-5999. You can find these fees further down on the page. Relocating Within North Carolina.

In North Carolina it will always be at 3. The North Carolina state sales tax rate is currently. Sales and Use Tax Rates Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information.

Division of Motor Vehicles collects as defined by law on behalf of counties. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees.

Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward. Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property. Has impacted many state nexus laws and sales tax collection requirements.

Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250. This is the total of state and county sales tax rates. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Your county vehicle property tax due may be higher or lower depending on other factors. The latest sales tax rate for Wake Forest NC. This rate includes any state county city and local sales taxes.

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. 025 lower than the maximum sales tax in NC. The department also collects gross receipts taxes.

The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. Wake County Tax Administration Rental Vehicle Tax Division PO. Contact your county tax department for more information.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. You can print a 725 sales tax table here. As for zip codes there are around 60 of them.

You can find more tax rates and allowances for Wake County and. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Box 2331 Raleigh NC 27602-2331 Please be certain to provide the mailing address to be used on your refund check.

2020 rates included for use while preparing your income tax deduction. 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. In Person Locate a registration renewal office near you.

Used Jaguar For Sale In Raleigh Nc Cargurus

1 Killed 1 Charged In Crash That Closed Wake Forest Road For Several Hours Wral Com

2019 Toyota Highlander In Wake Forest Nc Toyota Highlander Crossroads Nissan Wake Forest

Carolina Skiff Center Consoles For Sale

Wake County Nc Property Tax Calculator Smartasset

Used Audi S4 For Sale In Raleigh Nc Cargurus

Used Cars For Sale In Raleigh Nc Cars Com

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

238 N Main St Wake Forest Nc 27587 Realtor Com

North Carolina Nc Car Sales Tax Everything You Need To Know

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vincent Allen Project Archives The Old House Life Old Things Updating House Old House

Public Safety Camp Town Of Wake Forest Nc

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More